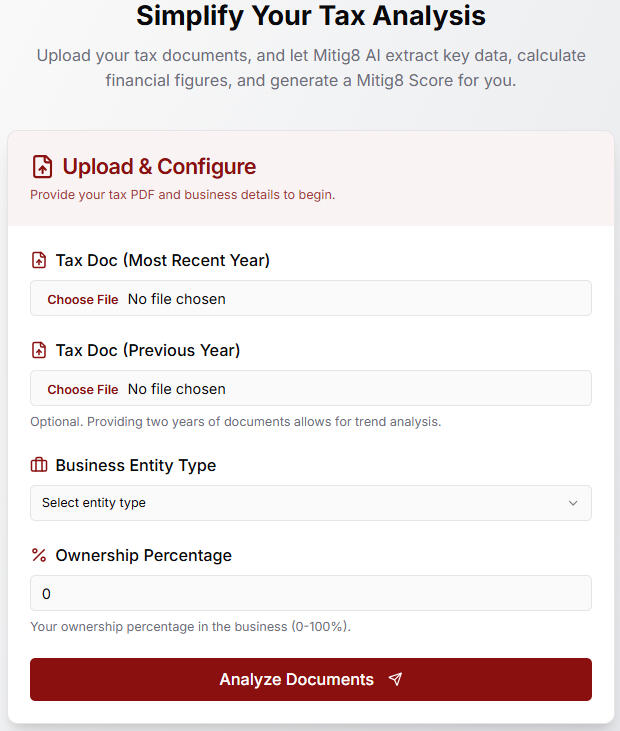

Upload Tax Docs & Get Borrower Income in 90 Seconds

Automated, accurate, and built for busy mortgage pros.

Not sure where to start?

Still doing self-employed income calcs by hand?

Stop digging through tax PDFs and guessing at numbers.Mitig8 AI reads tax docs and calculates qualifying income instantly — with smart logic that matches what underwriters want to see.

Featured Articles

Ready to Simplify Self-Employed Lending?

Features Videos:

Why Use Mitig8 AI?Risk Mitigation Beyond Borders:

Our advanced machine learning algorithms perform a comprehensive analysis of business tax filings for self-employed applicants. This not only expedites the approval process but also minimizes risks, allowing you to make informed lending decisions with confidence.Accelerated Processing, Amplified Results:

Time is of the essence in mortgage lending. Mitig8 AI dramatically reduces processing times by automating the evaluation of self-employed applicants. Streamline your workflow, meet deadlines, and stay steps ahead of the competition.Unlock New Business Horizons:

Mitig8 AI opens doors to the underserved market of self-employed individuals. Gain insights into creditworthiness and potential mortgage approvals, empowering you to extend your services to a broader clientele and maximize business growth.Data-Driven Decision-Making:

Leverage Mitig8 AI's detailed and accurate insights to make data-driven lending decisions. Equip your team with the information needed to tailor mortgage solutions, offer competitive rates, and foster customer satisfaction.Seamless Tech Integration:

Mitig8 AI seamlessly integrates into your existing systems, ensuring compatibility with your workflow, online applications, and digital processing systems. Embrace technology that enhances efficiency without disrupting your established operations.Build Trust, Foster Success:

Enhance customer relationships by providing precise mortgage approval projections. With Mitig8 AI, your institution becomes a trusted partner dedicated to the success of self-employed homebuyers.At Mitig8 AI, we believe that the future of mortgage lending lies in the fusion of advanced technology, strategic insights, and a commitment to excellence. Join us on this transformative journey and redefine what's possible in mortgage lending.Ready to elevate your mortgage lending experience? Let Mitig8 AI be your guide.

Ready to See How Much Faster You Can Close Loans?

Mitig8 AI is transforming how top brokers analyze income—and you’re one click away from seeing it for yourself.

Mitig8 AI 2025 ©

Resources

Exclusive discount for LoanLogic members — [Affiliate Offer].

Text

Text

Browse by Category

Income Analysis Tools

Text

Text

Text

💡 Recommended Partner: [Affiliate Name]

Featured Videos

Text

Text

Text

Text

Text

Text

💡 Recommended Partner: [Affiliate Name]

About Us

Welcome to Mitig8 AI, where innovation meets efficiency in the realm of mortgage lending. At Mitig8 AI, we are driven by a singular vision: to revolutionize the way self-employed income is calculated during the mortgage qualification process. Our cutting-edge app is designed to empower mortgage lenders and self-employed individuals, providing them with a streamlined and intelligent solution.Our MissionEmpowering Mortgage Lending:Mitig8 AI is on a mission to simplify the complexities associated with evaluating self-employed income in the mortgage industry. We believe that by leveraging advanced technologies such as machine learning and document analysis, we can enhance the efficiency of mortgage qualification, making the process faster, more accurate, and ultimately more accessible.Our VisionAt Mitig8 AI, our vision is to pioneer a transformative shift in the mortgage lending industry by redefining how self-employed income is evaluated. We envision a future where mortgage qualification is not only more accurate and efficient but also accessible to a broader spectrum of individuals. Mitig8 AI aims to be the leading force in shaping the next era of intelligent and user-friendly mortgage lending technology.

Our Values1. InnovationPioneering Solutions: We embrace a culture of continuous innovation. Our commitment is to pioneer groundbreaking solutions that challenge the status quo and set new benchmarks in the mortgage lending industry.2. EmpowermentUser-Centric Approach: We prioritize the needs of our users. Our values revolve around creating a user-centric experience that empowers mortgage lenders and self-employed individuals with the tools they need to succeed.3. IntegrityTransparency and Honesty: We uphold the highest standards of integrity. Transparency and honesty are at the core of our interactions with users, partners, and stakeholders.4. CollaborationBuilding Partnerships: Collaboration is key to our success. We value partnerships and actively seek to collaborate with industry experts, stakeholders, and users to create a more comprehensive and effective mortgage lending solution.5. AccessibilityInclusive Technology: We believe in making advanced technology inclusive. Our values center around creating solutions that are accessible to a diverse audience, ensuring that the benefits of intelligent mortgage qualification reach a broad spectrum of users.6. ExcellenceStriving for Excellence: We are dedicated to excellence in every aspect of our work. From product development to user experience, we continuously strive for excellence to deliver a product that exceeds expectations.

Eliminate Tax Return Analysis Errors Forever in Just 7 Proven Steps

Say Goodbye to Compliance Audits and Endless Rework—Guaranteed

Underwriting errors cost loan officers time, deals, and reputation.

But what if you had a guaranteed blueprint for zero-errors every single time?This guide reveals:7 simple SOPs your team can implement immediately.Common underwriting errors—and how to completely eliminate them.How mortgage lenders are using AI today to automate the final 10% of error-prone tasks.Stop letting simple mistakes sabotage your business.Yes, Send My Free Zero-Error Blueprint → ⬇️

Exclusive discount for LoanLogic members — [Affiliate Offer].

Text

Text

Finally—A Faster, Smarter, Zero-Guesswork Way to Calculate Borrower Income

Mitig8 AI helps mortgage brokers close more loans, eliminate errors, and speed up underwriting with enterprise-grade automation.

Your Biggest Bottleneck Isn’t Leads—It’s Income Calculation Delays

Every day, mortgage brokers lose deals to slow underwriting, unclear documentation, and inconsistent income calculations.

Mitig8 AI fixes all of that—with automation so accurate and transparent your underwriters will thank you.

AI-Driven Income Analysis Built for Mortgage Pros Who Can’t Afford Mistakes

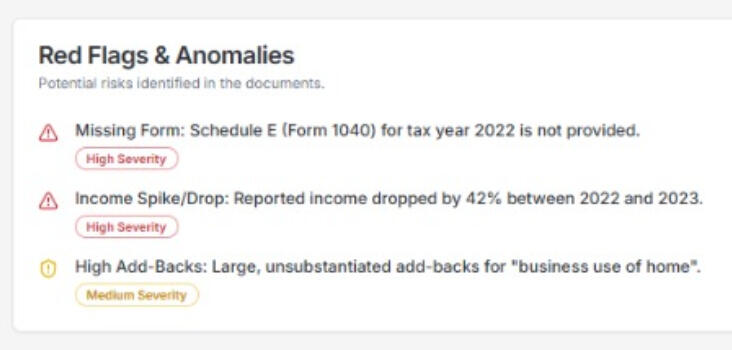

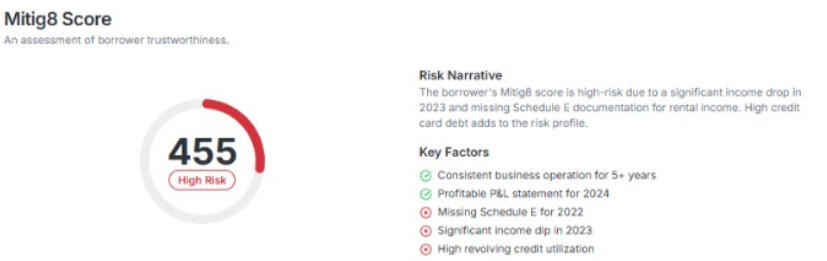

🔹 Mitig8 Score™ – The Industry’s First “Income Confidence Index”

A proprietary scoring system that instantly evaluates income stability, consistency, and risk—giving you one simple number to guide decisions.🔹 AI Confidence Score – Know Why the AI Reached Its Conclusion

Every calculation comes with a transparent confidence rating and an explanation trail your underwriters can audit.🔹 Instant Document Parsing (OCR + Intelligence)

Bank statements, tax returns, K-1s, 1099s, W-2s—analyzed in seconds with zero manual entry.🔹 Full API Access for Serious Integrators

Plug Mitig8 AI directly into your LOS or internal systems.

We provide a Postman Collection for immediate testing.🔹 Enterprise-Grade Security

SOC-2 level standards, full encryption, anonymized document handling, and compliant data retention.🔹 Enterprise-Friendly Pricing

Scale your team with predictable, audit-ready pricing—no per-loan penalties, no hidden upcharges.

Try Mitig8 AI First With a Low-Risk Pilot Program

For qualified mortgage brokerages, we offer a 30-day pilot to prove the ROI before any long-term commitment.The result?95% of pilot partners upgrade to full enterprise access.

Ready to See How Much Faster You Can Close Loans?

Mitig8 AI is transforming how top brokers analyze income—and you’re one click away from seeing it for yourself.

Mitig8 AI 2025 ©

Stop Losing Loans Over Self-Employed Income Calculations

Automate tax form income calculations in 60 seconds— fast, compliant, and accurate.

"When I started mortgage lending there was a high learning curve due to working with small business owners who had complicated taxes. I miscalculated income a few times and it was not caught until it was too late a few times. This really burned me with a few realtors and their clients. I knew we had spreadsheets to help but I had to manually enter my data into it after finding it and it led to data that was entered incorrectly. I then made Mitig8 Ai to help me never have that issue again. It is a drag and drop self employed tax reader for mortgage lenders that specializes in conventional and FHA loans." - Marcelo Bayon, Mitig8 Ai Founder

Advanced Features for Large-Scale Operations

Mitig8 AI Enterprise goes beyond the standard, offering advanced features designed to enhance efficiency in large-scale mortgage lending operations. From automated document analysis to sophisticated machine learning algorithms, our platform provides the tools your team needs to stay ahead in a competitive market.

1. Upload Tax Docs

From automated document analysis to sophisticated machine learning algorithms, our platform provides the tools your team needs to stay ahead in a competitive market.

2. Choose Calculation Logic

Mitig8 AI Enterprise goes beyond the standard, offering advanced features designed to enhance efficiency in large-scale mortgage lending operations. From automated document analysis to sophisticated machine learning algorithms, our platform provides the tools your team needs to stay ahead in a competitive market.

1. Upload Tax Docs

Mitig8 AI Enterprise goes beyond the standard, offering advanced features designed to enhance efficiency in large-scale mortgage lending operations.From automated document analysis to sophisticated machine learning algorithms, our platform provides the tools your team needs to stay ahead in a competitive market.

3. Get Report Instantly

Mitig8 AI Enterprise goes beyond the standard, offering advanced features designed to enhance efficiency in large-scale mortgage lending operations. From automated document analysis to sophisticated machine learning algorithms, our platform provides the tools your team needs to stay ahead in a competitive market.

Mitig8 AI 2025 ©

About Us

Text

Text

Text

💡 Recommended Partner: [Affiliate Name]

Exclusive Affiliate Offers

Exclusive discount for LoanLogic members — [Affiliate Offer].

Text

Text

Ready to Simplify Self-Employed Lending?

Mitig8 AI 2025 ©

Introducing the Mitig8 Score™: The New Standard for Self-Employed Income Confidence

Every lender knows the feeling: you’ve got a great borrower on paper, but the second you open their tax returns — the confidence fades. Too many variables. Too many interpretations. That’s why we built the Mitig8 Score™.For decades, the lending world has relied on FICO to assess credit risk — but there’s never been a standard way to measure income risk, especially for self-employed borrowers. Until now.The Mitig8 Score™ is an AI-powered confidence rating that evaluates the reliability of a borrower’s income based on real tax documents, cash flow patterns, and document consistency. In seconds, it delivers a *numeric score ** that shows how dependable that income really is.With the Mitig8 Score, originators can:- Pre-qualify faster with confidence

- Reduce underwriting back-and-forth

- Avoid deal-killing surprises

- Close more loans in less timeUnderwriters and investors can:- Instantly gauge risk levels

- Compare borrowers apples-to-apples

- Standardize audit trails and complianceIt’s not just automation. It’s insight.👉 See your first Mitig8 Score™ free today. Know your borrower’s true income confidence in 90 seconds.

Simplifying Mortgage Lending: The Power of Automated Document Analysis with Mitig8 AI

Introduction:In the world of mortgage lending, analyzing complex tax documents and extracting relevant information manually can be a daunting task. Yet, it's a crucial step in the lending process, and inaccuracies or delays can have significant consequences. In this blog post, we'll delve into the pain points associated with complex document analysis in mortgage lending and explore how Mitig8 AI's automated document analysis capabilities are revolutionizing the industry.The Challenge of Complex Document Analysis:Tax returns, bank statements, and other financial documents are essential for assessing a borrower's financial health and determining their eligibility for a mortgage. However, these documents are often complex and filled with nuanced information that can be challenging to decipher manually.Loan officers and underwriters are tasked with poring over these documents, identifying relevant information, and inputting it into the lending system. This manual process is not only time-consuming but also prone to errors, as even the slightest mistake can lead to misinterpretation of financial data and inaccurate lending decisions.Moreover, with the increasing complexity of financial documentation and the growing volume of mortgage applications, the burden of manual document analysis has become even more pronounced. Loan officers often find themselves overwhelmed by the sheer volume of paperwork, leading to inefficiencies in the lending process and frustrating delays for borrowers.The Consequences of Manual Document Analysis:The consequences of errors or delays in document analysis can be far-reaching. Inaccurate assessments of a borrower's financial situation can result in incorrect loan calculations, misinterpretation of financial data, and ultimately, faulty lending decisions.Furthermore, delays in document analysis can lead to prolonged processing times, frustrating borrowers and potentially causing them to seek alternative lenders. In today's competitive market, where speed and efficiency are paramount, such delays can have a significant impact on a lender's reputation and bottom line.The Solution: Automated Document Analysis with Mitig8 AIEnter Mitig8 AI – a game-changing software solution that is transforming the mortgage lending landscape. At the heart of Mitig8 AI is its automated document analysis capabilities, which eliminate the need for manual review and extraction of information from complex financial documents.By leveraging advanced machine learning algorithms, Mitig8 AI can analyze tax returns, bank statements, and other financial documents with unparalleled speed and accuracy. The software can identify key data points, such as income, assets, and liabilities, and extract them automatically, saving users countless hours of tedious work and minimizing the risk of errors.Benefits of Automated Document Analysis with Mitig8 AI:Time Savings: With Mitig8 AI's automated document analysis capabilities, loan officers and underwriters can significantly reduce the time spent on manual document review and extraction. This allows them to focus on more strategic tasks, such as client engagement and loan analysis, leading to increased productivity and efficiency.Accuracy: Mitig8 AI virtually eliminates the risk of errors associated with manual document analysis. By automating the process, the software ensures that all relevant information is accurately captured and extracted from complex financial documents, reducing the likelihood of costly mistakes and inaccuracies in lending decisions.Enhanced Compliance: Compliance with regulatory requirements is a top priority for mortgage lenders. Mitig8 AI's automated document analysis features help ensure compliance by accurately capturing and documenting all relevant information from financial documents, reducing the risk of non-compliance and associated penalties.Improved Decision-Making: By providing timely and accurate insights into borrowers' financial situations, Mitig8 AI empowers lenders to make more informed lending decisions. The software enables lenders to assess risk more effectively, identify opportunities for loan approval, and streamline the underwriting process.Better Customer Experience: Faster, more accurate document analysis translates to a better overall customer experience for borrowers. With Mitig8 AI, borrowers can expect quicker loan approvals and smoother transactions, leading to higher satisfaction and loyalty.Conclusion:Complex document analysis has long been a pain point in the mortgage lending industry, leading to inefficiencies, errors, and delays. However, with the advent of Mitig8 AI's automated document analysis capabilities, mortgage professionals can now streamline their operations and achieve new levels of efficiency and accuracy. By embracing automation, lenders can not only improve their internal processes but also enhance the overall customer experience, ultimately positioning themselves for success in today's dynamic market landscape.

Self-Employed Income Calculation Made Smarter: Unveiling Mitig8 AI

In the dynamic landscape of mortgage lending, calculating self-employed income has traditionally been a complex and time-consuming process. However, with the advent of innovative technologies, the game is changing. Mitig8 AI stands at the forefront of this transformation, offering advanced features that make self-employed income calculation smarter and more efficient than ever before.### The Challenge of Self-Employed Income CalculationSelf-employed individuals often face unique challenges when seeking mortgage approval. Traditional methods of income verification may not capture the diverse sources and fluctuations inherent in self-employment. Lenders need a solution that goes beyond conventional approaches, providing accurate assessments that reflect the dynamic nature of self-employed income.Mitig8 AI addresses this challenge head-on, leveraging cutting-edge technologies to streamline and enhance the self-employed income calculation process.1. Machine Learning Algorithms: Unleashing Predictive PowerAt the heart of Mitig8 AI's advanced features lies the power of machine learning algorithms. These algorithms are designed to analyze vast sets of data, learn from patterns, and make predictions. In the context of self-employed income calculation, this means Mitig8 AI can adapt and evolve based on historical data, providing increasingly accurate projections over time.Traditional methods often rely on static models that struggle to keep pace with the nuances of self-employed income. Mitig8 AI's machine learning algorithms, on the other hand, continuously refine their understanding, making them a powerful tool for lenders looking to make informed and predictive decisions.2. Automated Document Analysis: Efficiency RedefinedOne of the significant bottlenecks in self-employed income calculation is the manual analysis of financial documents. Mitig8 AI introduces a paradigm shift with automated document analysis. By leveraging optical character recognition (OCR) and natural language processing (NLP), the platform can swiftly extract relevant information from a variety of financial documents.Whether it's tax returns, bank statements, or other financial records, Mitig8 AI's automated document analysis accelerates the process, reducing the time and effort traditionally required for data extraction. This not only enhances efficiency but also minimizes the risk of human error associated with manual data entry.3. Real-Time Data Integration: Stay Ahead of the CurveIn the fast-paced world of mortgage lending, having access to real-time data is crucial. Mitig8 AI integrates seamlessly with external data sources, allowing lenders to pull in the latest financial information directly into the platform. This real-time data integration ensures that lenders are working with the most up-to-date information, enabling them to make timely and well-informed decisions.4. Customizable Workflows: Tailored to Your ProcessEvery lending institution has its unique workflow and processes. Mitig8 AI understands the importance of flexibility and offers customizable workflows that can be tailored to align with the specific requirements of each lender. This not only enhances user experience but also ensures that Mitig8 AI integrates seamlessly into existing operations.5. Predictive Analytics: Anticipate Future TrendsMitig8 AI doesn't stop at current income assessments. It goes a step further by incorporating predictive analytics. By analyzing historical trends and market indicators, Mitig8 AI can provide lenders with insights into potential future income trends for self-employed individuals. This forward-looking approach is invaluable for lenders seeking to anticipate changes in income patterns and make proactive lending decisions.### The Mitig8 AI Difference: Redefining Mortgage Lending TechnologyMitig8 AI's advanced features represent a significant leap forward in the realm of mortgage lending technology. By combining the power of machine learning, automated document analysis, real-time data integration, customizable workflows, and predictive analytics, Mitig8 AI offers a comprehensive solution that addresses the complexities of self-employed income calculation.Lenders leveraging Mitig8 AI gain a competitive edge in the market by making faster, more accurate, and forward-looking lending decisions. The platform's user-centric design ensures that these advanced features are accessible and intuitive, empowering lenders to harness the full potential of innovative technology without a steep learning curve.In conclusion, Mitig8 AI is not just a mortgage qualification tool; it's a game-changer for lenders navigating the intricacies of self-employed income calculation. The advanced features outlined here are a testament to Mitig8 AI's commitment to shaping the future of mortgage lending, one calculated decision at a time.

Who Are The Mitigators? The Tribe Leading the Future of Lending

The mortgage industry is changing — fast.

Borrowers expect transparency. Lenders need accuracy. And self-employed income continues to be one of the most misunderstood, miscalculated, and time-consuming challenges in the field.In the middle of that chaos, a new movement is rising.

A tribe committed not just to doing the job, but to elevating the entire industry.We call them Mitigators.Mitigators are more than originators, processors, or underwriters.

They're advisors, educators, and architects of clarity in a landscape that has grown too complex for the old way of doing things. They aren’t here to patch broken systems; they’re here to build new highways.At the core of this movement are the 8 Core Values of a Mitigator — the mindset that separates today’s loan officer from tomorrow’s industry leader.Truth Over TraditionMitigators challenge assumptions and outdated playbooks. They don’t accept “we’ve always done it that way” as an answer.We Fight for Both SidesBorrowers deserve clarity. Lenders deserve accuracy. Mitigators bring both into alignment.Empathy Backed by DataPeople matter — and so do the numbers. A true Mitigator balances humanity and analytics.We Don’t Guess — We ProveNo more “it looks good to me.” Evidence, documentation, and reproducible logic win every time.We Own the Tools of the FutureTechnology isn’t the threat. It’s the amplifier. Mitigators use the tools that give them leverage.We Scale TrustConsistency becomes a competitive edge. Mitigators build systems that make reliability repeatable.We Are Not the System — We Are the UpgradeThe industry doesn’t improve by accident. It improves because leaders demand better.We Are MitigatorsThis isn’t a title. It’s a commitment to elevating the profession.The Mitig8 Score and Mitig8 AI were created to support this new era — not by replacing professionals, but by empowering them with clarity, speed, and standardized income logic. The tool is only part of the story. The tribe is the real force behind the movement.As we prepare for the release of The Mitigators Manifesto (the book), this tribe is growing — united by a simple belief:We can fix what’s broken.

We can elevate the standard.

And the future of lending moves through us.If you feel that call… you’re already one of us.Welcome to the movement.

Welcome to the Mitigators.

The mortgage industry is changing — fast.

Borrowers expect transparency. Lenders need accuracy. And self-employed income continues to be one of the most misunderstood, miscalculated, and time-consuming challenges in the field.In the middle of that chaos, a new movement is rising.

A tribe committed not just to doing the job, but to elevating the entire industry.We call them Mitigators.Mitigators are more than originators, processors, or underwriters.

They're advisors, educators, and architects of clarity in a landscape that has grown too complex for the old way of doing things. They aren’t here to patch broken systems; they’re here to build new highways.At the core of this movement are the 8 Core Values of a Mitigator — the mindset that separates today’s loan officer from tomorrow’s industry leader.Truth Over TraditionMitigators challenge assumptions and outdated playbooks. They don’t accept “we’ve always done it that way” as an answer.We Fight for Both SidesBorrowers deserve clarity. Lenders deserve accuracy. Mitigators bring both into alignment.Empathy Backed by DataPeople matter — and so do the numbers. A true Mitigator balances humanity and analytics.We Don’t Guess — We ProveNo more “it looks good to me.” Evidence, documentation, and reproducible logic win every time.We Own the Tools of the FutureTechnology isn’t the threat. It’s the amplifier. Mitigators use the tools that give them leverage.We Scale TrustConsistency becomes a competitive edge. Mitigators build systems that make reliability repeatable.We Are Not the System — We Are the UpgradeThe industry doesn’t improve by accident. It improves because leaders demand better.We Are MitigatorsThis isn’t a title. It’s a commitment to elevating the profession.The Mitig8 Score and Mitig8 AI were created to support this new era — not by replacing professionals, but by empowering them with clarity, speed, and standardized income logic. The tool is only part of the story. The tribe is the real force behind the movement.As we prepare for the release of The Mitigators Manifesto (the book), this tribe is growing — united by a simple belief:We can fix what’s broken.

We can elevate the standard.

And the future of lending moves through us.If you feel that call… you’re already one of us.Welcome to the movement.

Welcome to the Mitigators.

Who Are The Mitigators? The Tribe Leading the Future of Lending

In the realm of mortgage qualification, where precision and efficiency are paramount, Mitig8 AI takes a pioneering approach by placing user experience at the forefront of its design philosophy. In this blog post, we delve into the principles that underpin Mitig8 AI's commitment to user-centric design, exploring how this approach is reshaping the landscape of mortgage lending and making the qualification process more straightforward and efficient.### Understanding User-Centric Design in Mortgage LendingUser-centric design is more than just a buzzword; it's a fundamental shift in perspective that places the user at the center of the design and development process. For Mitig8 AI, this means understanding the needs, expectations, and pain points of users in the mortgage lending sector, and crafting a solution that not only meets but exceeds those expectations.1. Intuitive Interface: Simplifying ComplexityMortgage qualification involves intricate processes and data points, and Mitig8 AI recognizes the need for simplicity in handling this complexity. The platform boasts an intuitive interface that guides users through the qualification journey seamlessly. From uploading financial documents to receiving approval projections, every step is designed with clarity and ease of use in mind. Mitig8 AI believes that a simplified interface empowers users, whether they are seasoned lending professionals or first-time homebuyers.2. Accessibility Across Devices: Anytime, AnywhereUser-centric design extends beyond the desktop to embrace the diversity of devices users employ in their daily lives. Mitig8 AI ensures that its platform is accessible across a range of devices, from laptops to tablets and smartphones. This flexibility not only accommodates the varying preferences of users but also empowers them to engage with the platform anytime, anywhere. The goal is to make the mortgage qualification process convenient and seamlessly integrated into users' lifestyles.3. Personalization: Tailoring the ExperienceNo two users are the same, and Mitig8 AI's user-centric design recognizes this diversity. The platform incorporates personalization features that allow users to tailor their experience based on individual preferences. Whether it's customizing dashboards, setting notification preferences, or choosing preferred workflows, Mitig8 AI empowers users to shape their interaction with the platform to align with their unique needs and working styles.4. Feedback Loops: Continuous ImprovementUser-centric design is an iterative process that thrives on feedback. Mitig8 AI actively encourages user feedback and incorporates it into the ongoing development of the platform. Regular updates and feature enhancements are driven by insights gathered from user experiences. By fostering a feedback loop, Mitig8 AI ensures that the platform evolves in tandem with the changing needs and expectations of its user base.5. Training and Support: Guiding Users Every Step of the WayEmpowering users involves more than just providing a tool; it's about ensuring they have the knowledge and support needed to leverage that tool effectively. Mitig8 AI invests in comprehensive training resources and support systems to guide users at every step of the mortgage qualification process. Whether through video tutorials, live training sessions, or a responsive support team, Mitig8 AI is committed to equipping users with the skills and confidence to make the most of the platform.### Case Study: The Impact of User-Centric DesignTo illustrate the real-world impact of user-centric design, let's explore a case study involving a mortgage lending institution that embraced Mitig8 AI's platform.### Case Study: Streamlining Onboarding for Lending ProfessionalsA large lending institution sought to streamline the onboarding process for its lending professionals. Mitig8 AI's user-centric design facilitated a seamless onboarding experience, reducing the learning curve for new users. The intuitive interface, coupled with personalized training resources, empowered lending professionals to navigate the platform with ease. The result was a more efficient onboarding process, allowing lending professionals to quickly integrate Mitig8 AI into their daily workflows.### The Future of Mortgage Lending: User-Centric Design as a Game-ChangerAs we look to the future, Mitig8 AI envisions user-centric design as a game-changer in the mortgage lending landscape. The principles of simplicity, accessibility, personalization, feedback loops, and comprehensive support are not just design elements; they are pillars shaping a future where the mortgage qualification process is not a daunting task but a user-friendly and empowering journey.Mitig8 AI's commitment to user-centric design is not just about creating a platform; it's about fostering a positive and productive relationship between users and technology. As the platform continues to evolve, guided by the principles of user-centric design, the mortgage lending experience is poised to become not only more straightforward and efficient but also a source of empowerment for users across the industry.

Enterprise Solutions: Scaling Mortgage Lending Operations with Mitig8 AI

In the fast-evolving landscape of mortgage lending, the need for scalable and efficient solutions is paramount, especially for large-scale enterprises. Mitig8 AI emerges as a trailblazer, addressing the unique challenges faced by these organizations and ushering in a new era of streamlined operations and sustained competitiveness. In this blog post, we explore how Mitig8 AI's enterprise solutions are reshaping the landscape of mortgage lending.### Understanding the Enterprise ChallengeLarge-scale enterprises in the mortgage lending sector encounter a myriad of challenges that stem from the complexity of their operations. These challenges include managing vast amounts of data, ensuring compliance with evolving regulations, and meeting the demands of a highly competitive market. Mitig8 AI recognizes these challenges as opportunities for innovation and enhancement.1. Tailored Solutions for Diverse WorkflowsMitig8 AI understands that one size does not fit all, especially when it comes to enterprise workflows. The platform offers tailored solutions that can be seamlessly integrated into the diverse workflows of large lending institutions. Whether it's adapting to unique approval processes or aligning with specific compliance requirements, Mitig8 AI provides the flexibility needed for enterprises to optimize their operations.2. Advanced Features for Large-Scale OperationsThe scale of enterprise operations demands advanced features that go beyond the capabilities of standard solutions. Mitig8 AI introduces a suite of advanced features designed specifically for large-scale mortgage lending. From machine learning algorithms for predictive analytics to real-time data integration, these features empower enterprises to make informed decisions with speed and accuracy.3. Case Studies: Real-world Success StoriesOne of the most compelling aspects of Mitig8 AI's enterprise solutions lies in the tangible impact they have had on organizations. Let's explore a couple of case studies that highlight how Mitig8 AI has become an indispensable ally for enterprises aiming to scale their mortgage lending operations.### Case Study 1: Streamlining Approval ProcessesA leading mortgage lending institution faced challenges in streamlining its approval processes, resulting in delays and inefficiencies. By implementing Mitig8 AI's tailored solutions, the institution witnessed a significant reduction in approval time. The platform's machine learning algorithms not only expedited the analysis of financial documents but also provided predictive insights, allowing the institution to proactively address potential challenges in the approval pipeline.### Case Study 2: Enhancing Compliance ManagementCompliance is a top priority for enterprises, and Mitig8 AI understands the critical role it plays in the mortgage lending landscape. Another enterprise leveraged Mitig8 AI's advanced features to enhance its compliance management. The platform's real-time data integration ensured that the institution had access to the latest regulatory updates, and its customizable workflows facilitated seamless adherence to compliance requirements. The result was a more resilient and adaptable compliance framework that could swiftly respond to changes in regulations.4. Seamless Integration with Existing SystemsLarge enterprises often have established systems in place, and any new solution must seamlessly integrate with these existing frameworks. Mitig8 AI recognizes the importance of integration and offers solutions that can easily be incorporated into an enterprise's tech stack. Whether it's linking with CRM systems, document management tools, or other proprietary platforms, Mitig8 AI ensures a cohesive and interconnected ecosystem.5. Dedicated Support for Enterprise ClientsMitig8 AI goes beyond providing a software solution; it offers dedicated support tailored for enterprise clients. Large-scale operations require responsive and personalized assistance, and Mitig8 AI delivers just that. Enterprise clients benefit from priority access to support resources, personalized training sessions, and a dedicated account manager who understands the intricacies of their operations.### The Path Forward: Mitig8 AI and the Future of Enterprise Mortgage LendingAs we look ahead, Mitig8 AI's enterprise solutions emerge as a catalyst for shaping the future of mortgage lending for large-scale enterprises. The platform's commitment to customization, advanced features, real-world success stories, seamless integration, and dedicated support positions it as a transformative force in the industry.Mitig8 AI's vision is not just about providing a tool for enterprises; it's about co-creating a future where mortgage lending operations are not only efficient but also agile, resilient, and prepared for the challenges of tomorrow. As large-scale enterprises continue to explore innovative solutions for scaling their mortgage operations, Mitig8 AI stands as a reliable partner, offering a roadmap to sustained competitiveness in a dynamic market.

The Future of Mortgage Qualification: Mitig8 AI's Vision for Efficiency and Accuracy

The world of mortgage qualification is on the brink of a profound transformation, driven by the innovative vision of Mitig8 AI. In this blog post, we delve into the future of mortgage qualification, exploring the visionary technologies that propel Mitig8 AI and the imminent era of heightened efficiency and accuracy in the industry.### The Current Landscape: Challenges in Mortgage QualificationMortgage qualification has long been associated with complexities and inefficiencies. Lenders face challenges in accurately assessing an individual's eligibility for a mortgage, especially when considering the unique circumstances of self-employed individuals. Conventional methods often fall short in capturing the dynamic nature of income and financial circumstances, leading to delays, inaccuracies, and frustration for both lenders and applicants.Mitig8 AI enters this landscape with a bold vision to revolutionize how mortgage qualification is approached, leveraging cutting-edge technologies to overcome the limitations of traditional methods.1. Machine Learning at the Core: A Predictive ApproachMitig8 AI's vision hinges on the transformative power of machine learning. Unlike static models that struggle to adapt to evolving financial landscapes, machine learning algorithms form the core of Mitig8 AI's approach. These algorithms analyze vast datasets, learning patterns, and making predictive assessments.In the context of mortgage qualification, this means Mitig8 AI is not merely reacting to current financial situations but anticipates future trends. It learns from historical data, adjusts to changing circumstances, and provides lenders with predictive insights into an applicant's financial trajectory.2. Predictive Analytics: Beyond the PresentMitig8 AI doesn't stop at machine learning; it embraces predictive analytics. By examining historical trends and market indicators, Mitig8 AI equips lenders with foresight. This forward-looking approach allows lenders to assess not only the current financial state of an applicant but also anticipate potential changes in income and financial patterns.Predictive analytics offer a significant advantage in an industry where staying ahead of economic shifts and individual financial changes is paramount. Mitig8 AI empowers lenders to make proactive, informed decisions that align with both current and future financial realities.3. User-Centric Design: Accessibility and IntuitivenessIn envisioning the future of mortgage qualification, Mitig8 AI places a strong emphasis on user-centric design. Technological advancements are most impactful when they are accessible and intuitive. Mitig8 AI is committed to ensuring that its innovative technologies are not only cutting-edge but also user-friendly.The platform's interface is designed to be intuitive, minimizing the learning curve for lenders. By combining powerful technologies with an accessible design, Mitig8 AI aims to democratize the benefits of advanced mortgage qualification tools, making them readily available to a broad spectrum of lenders.4. Real-Time Data Integration: Timely and Informed DecisionsThe future of mortgage qualification is synonymous with real-time data integration. Mitig8 AI recognizes the importance of having the latest financial information at your fingertips. The platform seamlessly integrates with external data sources, ensuring that lenders are working with the most up-to-date information.Real-time data integration is particularly crucial in a rapidly changing economic environment. Mitig8 AI empowers lenders to make timely and well-informed decisions, responding to market shifts and individual financial changes in real-time.5. Holistic Approach: Addressing the Self-Employed ChallengeA significant aspect of Mitig8 AI's vision is its holistic approach to mortgage qualification, particularly for self-employed individuals. Traditional methods often struggle to capture the diverse and dynamic nature of self-employed income. Mitig8 AI's platform, driven by its visionary technologies, tackles this challenge head-on.Machine learning, predictive analytics, and real-time data integration come together to provide a comprehensive view of an applicant's financial situation, accounting for the intricacies of self-employment. Mitig8 AI is poised to redefine how lenders assess the eligibility of self-employed individuals, bringing a new level of accuracy and fairness to the process.The Road Ahead: Shaping the Future of Mortgage QualificationAs we glimpse into Mitig8 AI's vision for the future of mortgage qualification, it's clear that the industry is on the brink of a transformative era. The convergence of machine learning, predictive analytics, user-centric design, real-time data integration, and a holistic approach is set to redefine how lenders approach mortgage qualification.Mitig8 AI's commitment to efficiency and accuracy is not just a technological aspiration; it's a fundamental shift in perspective. The platform is not merely a tool; it's a visionary force propelling the mortgage industry toward a future where qualification is not just a process but a well-informed and forward-looking decision-making journey.In conclusion, Mitig8 AI's vision is not bound by the constraints of the present; it's a roadmap to a future where mortgage qualification is a seamless, predictive, and user-friendly experience. As Mitig8 AI shapes this future, the industry can look forward to a new standard of efficiency, accuracy, and fairness in mortgage qualification.